A Brexit Party MEP has accused Remainers of causing the pound to drop – because they have ‘hijacked’ a no-deal Brexit so it sounds like a ‘disaster’.

Ben Habib, the Brexit Party MEP for London and a businessman, said Remainers were driving down the pound.

He said that Remainers had “hijacked” a no-deal Brexit, and convinced “everyone” that it is a disaster.

The MEP told the Express: “The pound is down because Remainers, including former PM Theresa May and the EU machinery, have convinced everyone – including the markets – that no deal is a disaster.

“They have successfully hijacked that scenario. They are wrong.”

But the fall on the pound has been consistent since the Brexit result, and has only worsened after new prime minister Boris Johnson and his cabinet took a hardline stance on negotiations with the EU over Brexit.

Cabinet minister Michael Gove wrote in the Sunday Times that a “no-deal is now a very real prospect” and the government is “working on the assumption” of a no-deal Brexit.

Johnson has since insisted he will “go the extra thousand miles” to secure a deal, but with just two months to go until the October 31 Brexit deadline, many believe he has set the UK on course for a cliff-edge Brexit.

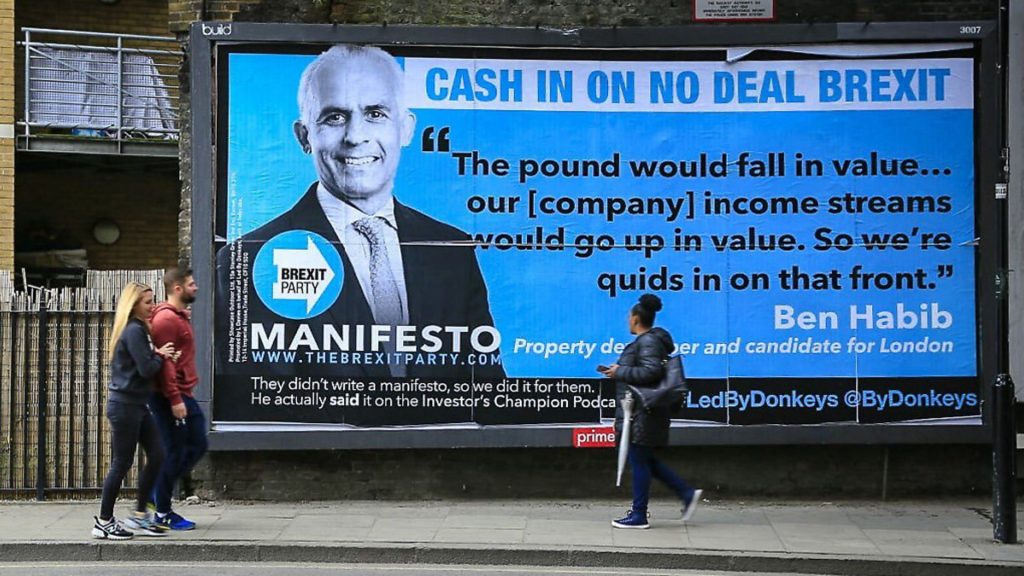

Habib’s comments appear to differ to what he was saying since the EU referendum, back then he said it was a good thing that the pound would fall.

He has described the “volatility” of Brexit provides an opportunity for his “opportunistic” company to profit.

It is claimed he said: “The pound would fall in value… our [company’s] income streams would go up in value. So we’re quids in on that front.”

Moreover he was accused by a BBC Newsnight presenter of “lining his own pockets while everyone goes bust.”

Tourist rates have already seen the pound fall below parity at airports, where holidaymakers are being offered as little as 97 euro cents for their pound.

This means that travellers to Europe will find their pound does not go very far while they will also get a poor dollar rate if they are going to the US or countries where the greenback is the main currency – hiking up the cost of everything from accommodation to food.

But it’s not just holidaymakers – all UK consumers stand to be impacted by a sustained plummet in the value of the pound, because it makes it more expensive for retailers and manufacturers to import food, goods and materials.

It means prices will be pushed up for goods and services, sending UK inflation rising and hitting Britons hard in the pocket.

Warning: Illegal string offset 'link_id' in /mnt/storage/stage/www/wp-includes/bookmark.php on line 357

Notice: Trying to get property 'link_id' of non-object in /mnt/storage/stage/www/wp-includes/bookmark.php on line 37